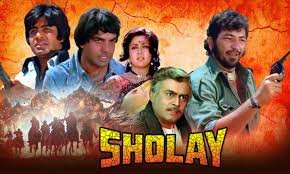

The iconic Bollywood film Sholay isn’t just a cinematic masterpiece; it’s also a treasure trove of life lessons, many of which are surprisingly applicable to the world of investing. Released in 1975, this Ramesh Sippy classic continues to resonate with audiences, and its characters and plotlines offer some remarkably pertinent insights for every investor. So, grab your popcorn, and let’s delve into the timeless financial wisdom hidden in the dusty plains of Ramgarh!

1. Diversification is Your Jai & Veeru 🤝

Imagine trying to take on Gabbar Singh with just one person. Impossible, right? Jai and Veeru, the dynamic duo, brought different strengths to the table – Jai’s calm strategic thinking and Veeru’s spontaneous courage. Together, they were formidable.

In investing, diversification is your Jai and Veeru. Relying on a single investment is like sending just one hero to face a gang of dacoits – highly risky! By spreading your investments across various asset classes (like stocks, bonds, real estate, and gold), industries, and geographies, you reduce the impact if one particular investment performs poorly. Don’t put all your eggs in one basket; let your portfolio have its own formidable duo (or even trio, or quartet!) to weather market storms.

2. Patience Pays Off (Like Waiting for Basanti) ⏳

Remember Basanti’s endless wait for Veeru to come and save her, or Thakur’s patient biding of time for the right moment to exact his revenge? Sholay teaches us that good things, and good outcomes, often require patience.

The stock market isn’t a get-rich-quick scheme. It has its ups and downs, much like the changing tides of loyalty in Ramgarh. Long-term investing often yields the best results, allowing your investments to compound over time. Panic selling during market downturns is akin to giving up just when help is on the way. Stay calm, maintain your long-term vision, and let your investments mature, much like the slow-burning plot of Sholay itself.

3. Research Your “Gabbar” (Know Your Investments) 🧐

Before Jai and Veeru could even think of tackling Gabbar, they needed to understand his tactics, his hideout, and his weaknesses. They gathered information and strategized.

Similarly, before you invest your hard-earned money, it’s crucial to thoroughly research what you’re putting it into. Don’t blindly follow tips or invest in something you don’t understand. Whether it’s a stock, a mutual fund, or real estate, understand its fundamentals, its risks, and its potential returns. Knowledge is power, and in investing, it’s your best defense against potential losses, your very own “Thakur” investigating the enemy.

4. Don’t Underestimate “Small” Risks (Even a Single Bullet Matters) ⚠️

A single bullet from Gabbar’s gun could have changed the entire course of the movie. While some risks seem small, they can have significant consequences.

In investing, don’t underestimate seemingly minor risks. Factors like inflation, interest rate changes, and geopolitical events might seem distant, but they can significantly impact your portfolio. Always be aware of the potential risks associated with your investments and have a plan to mitigate them. Regularly review your portfolio and adjust it as market conditions or your personal circumstances change. Being prepared for the unexpected is key to protecting your wealth.

Building on the previous blog post, here is some more content you can use to expand the piece, adding more nuanced and practical lessons from ‘Sholay’.

4 Timeless Investment Lessons from the Bollywood Classic ‘Sholay’ 🎬

The iconic Bollywood film Sholay isn’t just a cinematic masterpiece; it’s also a treasure trove of life lessons, many of which are surprisingly applicable to the world of investing. Released in 1975, this Ramesh Sippy classic continues to resonate with audiences, and its characters and plotlines offer some remarkably pertinent insights for every investor. So, grab your popcorn, and let’s delve into the timeless financial wisdom hidden in the dusty plains of Ramgarh!

5. Don’t Be Fooled by Jai’s Coin (Beware of Biased Information) 🪙

Jai’s two-headed coin was a genius plot device. It gave Veeru the illusion of choice, while Jai always knew the outcome would favor him. This is a powerful metaphor for the dangers of trusting biased information in the investing world.

Many “investment tips” you hear from friends, on social media, or from unverified sources are like Jai’s coin. They may seem to offer a win-win scenario, but the game is rigged from the start. A stock tip from a “finfluencer” with a vested interest, or an inflated valuation from a company’s marketing, can lead you down a path with only one possible outcome: a loss for you. Always do your own due diligence. Never invest based on a single, unverified “tip.” The only coin you should be flipping is your own, with clear heads and tails.

6. The Importance of Planning and Discipline (Thakur’s Long Game) 🎯

Thakur Baldev Singh’s revenge wasn’t a spontaneous act. It was a meticulously planned, long-term strategy. He didn’t rush in with a weapon; he used his mind, his network (Jai and Veeru), and his patience to achieve his goal.

In investing, discipline and a long-term plan are your greatest assets. A Systematic Investment Plan (SIP) is the perfect example of this. You don’t try to time the market (rush in for an instant win); you invest a fixed amount regularly, regardless of market highs or lows. This disciplined approach, over a long period, allows you to benefit from the power of compounding and rupee-cost averaging, building substantial wealth slowly and surely. Just like Thakur, who didn’t get his revenge overnight, your financial goals will be realized through a consistent, planned approach.

7. Understand Your Risk Tolerance (The “Kaalia” Test) ⚠️

Remember Gabbar’s famous line, “Kitne aadmi the?” The answer determined the fate of his men. The “Kaalia” test, in its brutal simplicity, highlights the importance of understanding your own limits and the limits of those you rely on.

In investing, you must ask yourself a similar question: “How much risk can I handle?” Your risk tolerance is a deeply personal metric. A young, single individual with a high-paying job can afford to be more aggressive and invest in high-growth, high-risk assets. A person nearing retirement, on the other hand, should prioritize capital preservation over high returns, shifting towards safer, more stable investments. Understanding and acting on your risk tolerance prevents you from making emotional decisions, like panic selling during a market downturn, because you’ve already defined what you can handle. Don’t be a Kaalia who overestimates his strength; be an investor who knows his limits.

8. Even the Best “Heroes” Can Fail (Market Volatility is Real) 📉

The death of Jai, the unflinching hero, was a powerful reminder that even the strongest can fall. It was a shocking twist that taught us a harsh lesson: no one is invincible.

Similarly, in the world of investing, there is no such thing as a “sure thing” or an “unflinching stock.” Even the most successful companies can face unexpected challenges, market shifts, or economic downturns. This is the essence of market volatility. The best investors understand that losses are a part of the journey. They don’t panic when their portfolio takes a hit; instead, they see it as a normal part of the cycle. They hold their nerve, re-evaluate their strategy, and stay invested for the long run. The story of Sholay shows that even after a great loss, life goes on and victory can still be achieved. So, too, can a portfolio recover and thrive after a temporary setback.